Energy efficient upgrades to a home can add value, lower your utility bills, and make you a “greener” citizen of the Earth. There are now a number of finance alternatives that have made these updates more accessible than ever before.

For example, you can lease solar systems and offset the monthly lease payment with the energy savings produced. You can also borrow money to install energy saving appliances, and have the loan payments added to your property tax bill. With all of these new finance alternatives, it has helped many homeowners who otherwise wouldn’t have been able to install these updates with their own savings.

But are these new finance options truly helping homeowners? We have spoken to a number of clients who weren’t aware of some of the fine print of these finance schemes, specifically how these lease and loan options create a lien on their property that make it difficult or even impossible to refinance their homes.

A trusted colleague told me early in my career that there is no free lunch in lending. In other words, you don’t get to borrow money without strings attached. Typically, that means you are paying interest, and in the case of real estate it also means you put your property up for security against the loan. Mortgages, for example, are recorded against the property and this loan must be paid off prior to selling or allowing another mortgage to be taken out.

Most folks recognize that they are going to pay interest if they borrow money from a solar or utility company, but what does not appear to be commonly understood is that these loans and leases are recorded against the property.

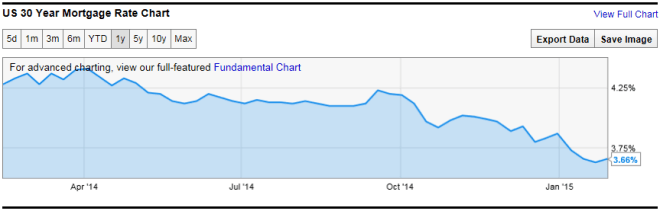

Several times in the last year, we have worked to help a client refinance to a lower interest rate and save money on their mortgage payment. During the underwriting process, we discover an additional lien resulting from a solar, window, HVAC, or other energy efficiency update. This secondary lien must either be paid off or give permission for the mortgage to be refinanced. Many times, the client either doesn’t want to or can’t pay off the loan, and the energy efficiency loan won’t allow the refinance to proceed. The refinance attempt ultimately fails. Ironically, the act to save money through energy efficient updates ends up handcuffing the client to a higher mortgage interest rate loan, thus losing more money to interest than what is being saved in lower utility costs.

Not all loan and lease terms are the same amongst the various options and vendors. And in some cases it probably makes sense to obtain one of these loans and live with the potential down sides. Simply be sure you know the fine print. Solar and other outfits are pushing these available financing options hard on homeowners, but there are more traditional finance options available that you may want to consider as well. A cash-out refinance, home equity line of credit, home improvement loan, or other form of traditional mortgage financing may make sense as well. As always, we are happy to discuss what options you may have and objectively point out the pros and cons of each.