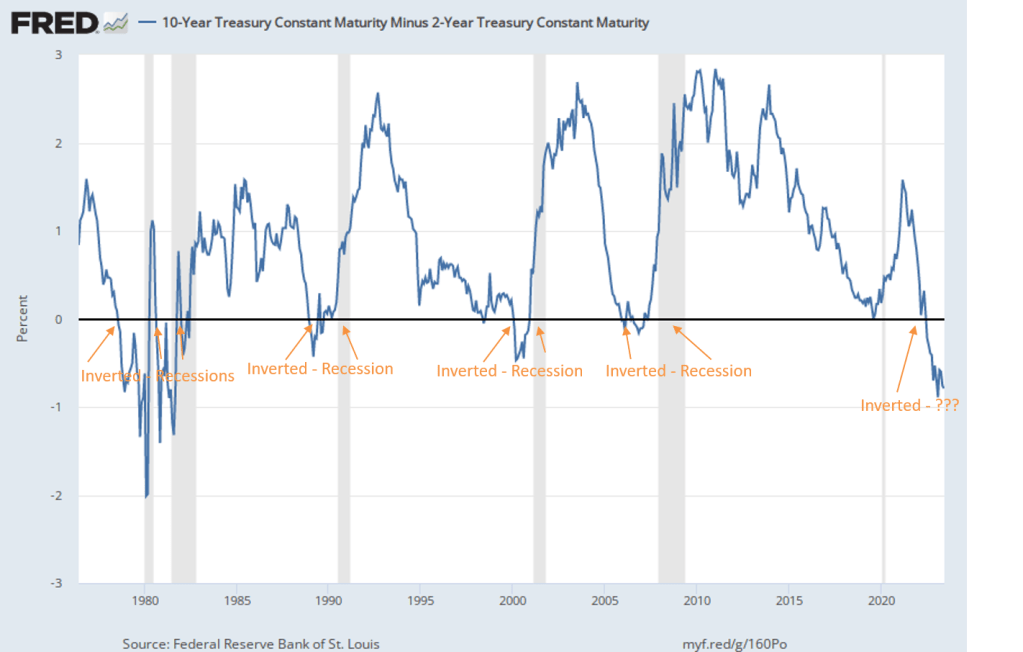

Once we’re in a recession, and one is coming very soon

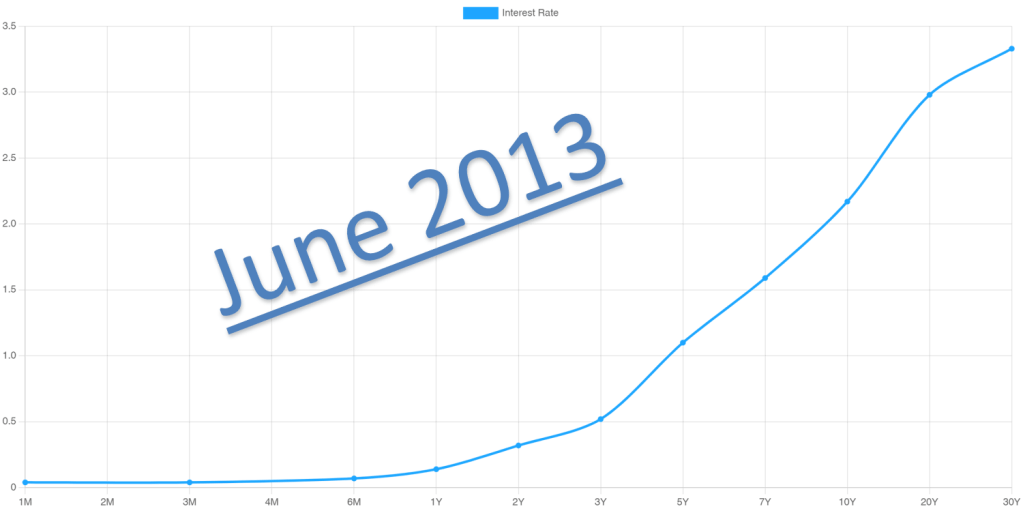

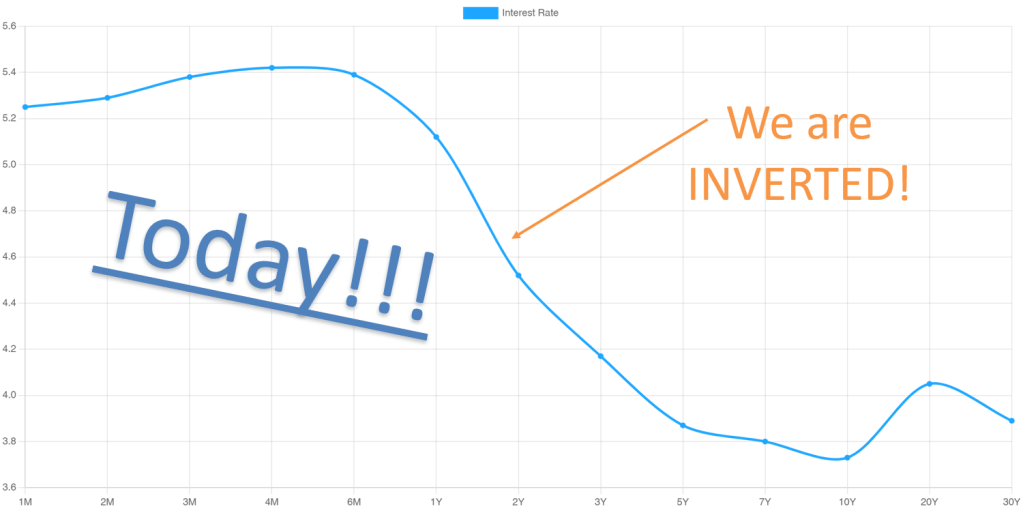

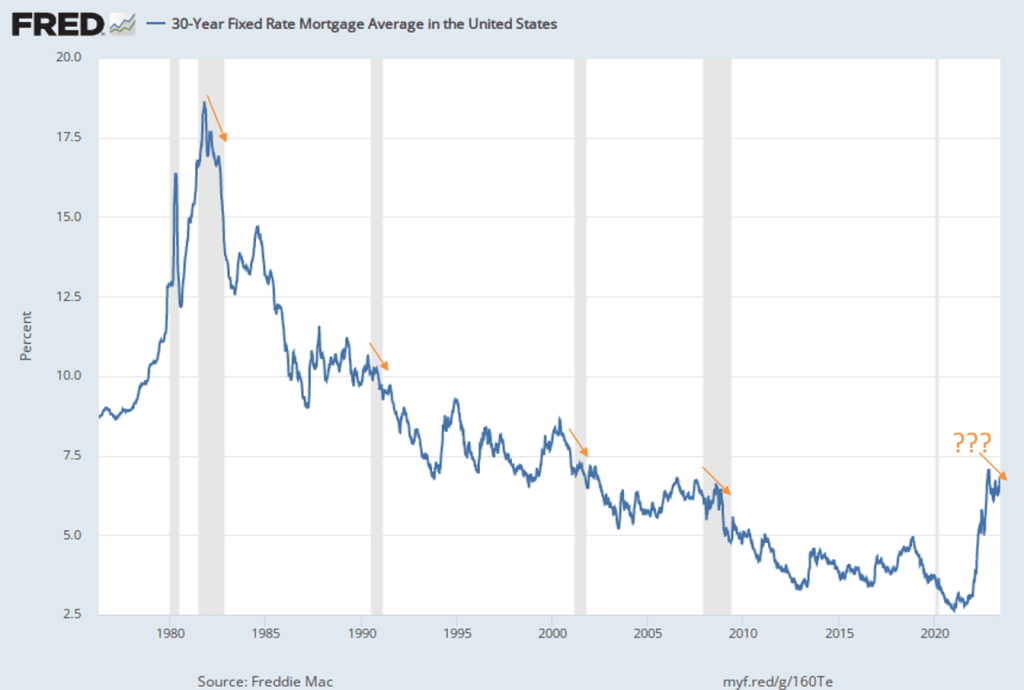

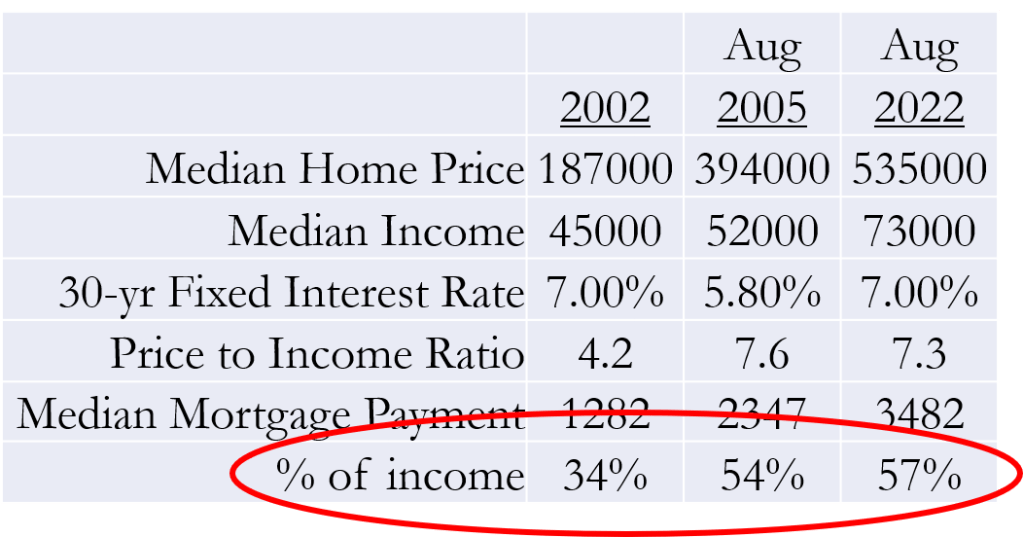

In my last post I shared that I see a recession brewing, leading to lower mortgage rates. Well, I think the stage is being set for our next recession right now. Here are 5 big story lines that just came out this week that will lead to slower economic growth (& thus lower mortgage rates!):

#1) Ongoing union strikes – the auto industry strikes are intensifying according to reports from earlier today, so this will slow down a cornerstone of our economy to the tune of $500 million a day in lost productivity.

#2) Government shutdowns – Congress avoided a shut down on Oct 1 by kicking the can down the road with a 45-day budget. But the unprecedented ousting of Speaker Kevin McCarthy could have a greater tumultuous impact on our government operations than a run-of-the-mill budget standoff. Regardless, a prolonged shutdown or inefficiencies within Congress in the coming weeks will impact economic output and further deteriorate the world’s faith in US fiscal responsibility.

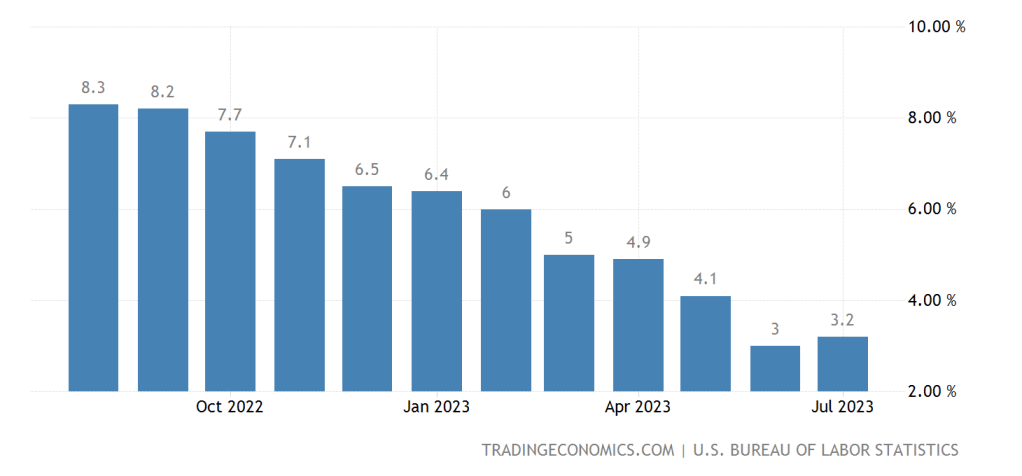

#3) Inflation is cooling – the latest core Personal Consumption Expenditure index came in at a .1% monthly increase, below expectations and heading in the right direction. This is a sign The Fed’s policies are working at slowing the economy and tipping things into recessionary territory.

#4) Student loan payments resume soon – nearly $1.6 trillion dollars in student loans will resume repayment status on Sunday (Oct 1st). After a 3.5 year reprieve, over 40 million Americans will now be tightening their purse strings as more of their monthly budget will go to paying their student loans.

#5) surging oil prices – gas prices are rising at an odd time of year (after Labor Day). Other than during the initial outbreak of the war in Ukraine, gas prices have never been higher. This will crimp consumers spending habits as we enter the important holiday season.

Many economists believe consumer spending has been what’s propped up our economy in recent months despite rising interest rates. Well, I believe that comes to an end this coming quarter, and a lousy holiday shopping season will be the beginning of a recession and interest rates will recede in early 2024.

I’ll be keeping my eye on these developing stories in the coming months, as they not only impact the direction of mortgage rates but they will also set the landscape for the 2024 election season. Buckle up! It should be a wild 12 months ahead. Thanks as always for watching, reading and tuning into my content. Have a great weekend!