Lets GET REAL about…Paperwork! Most of us hate it, but managing it, presenting it, and explaining it are crucial to a successful real estate transaction. Contract mastery may not be a skill emphasized on your favorite reality real estate TV show, but don’t hire a REALTOR that can’t effectively explain the paperwork you’re being asked to sign.

Category: Real Estate

Got Debt? You Are Not Alone

If your credit card balances are creeping up on you, it may be time for a cash-out refinance

Total US household debt continues to climb even as borrowing costs rise with higher interest rates, particularly on credit cards. The total debt level recently hit a NEW record amount of $17.29 trillion…with a T!!!

$1.08 TRILLION is attributed to credit card debt! Many of us are facing harder times with the on-going economic slow down, lingering inflation, and the resumption of federal student loan repayments. With credit card balances & their interest rates at all-time highs, it may be time to consider a cash-out refinance to consolidate high-rate loans.

Home values remain reasonably resilient & most homeowners have record levels of home equity. Even with elevated mortgage rates, it may be better to roll higher rate credit card debt into a new mortgage balance.

Has the economic slowdown forced you to borrow more against credit cards, cars, and education? Borrowing from your equity at a low rate to pay off higher rate debt will lower your overall monthly payments and lower your interest costs over the long-run. I can help you determine the “blended rate” of your various debts, the effective interest rate you’re paying across all of your loans (including your mortgage). If your blended rate is over 7%, then its time to consider a cash-out refinance.

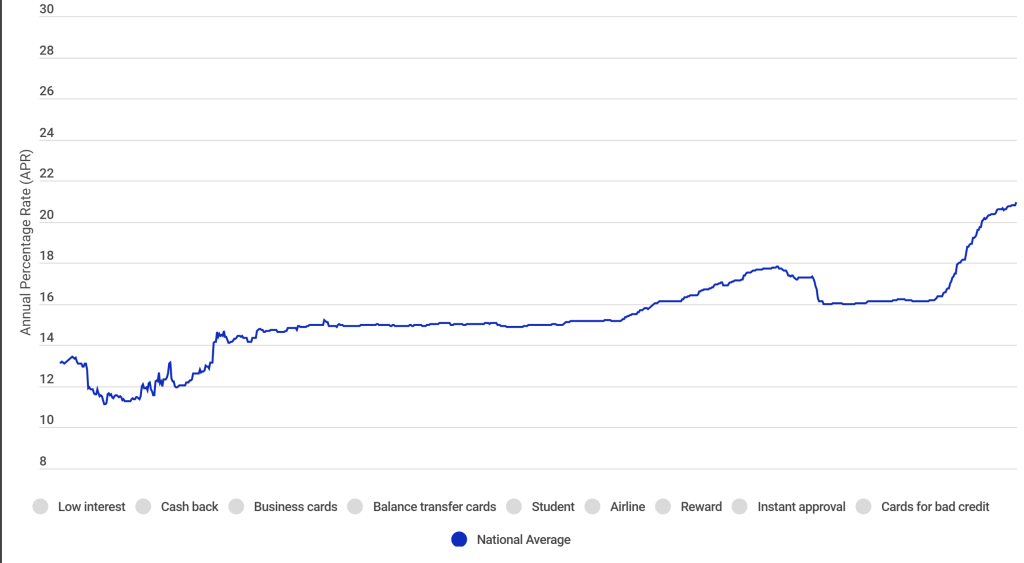

Consider the following graph…according to CreditCards.com the national average credit card interest rate is over 20%!. With The Fed suggesting they don’t plan to reduce the Federal Funds Rate any time soon, this will lead to high credit card rates for some time.

Let us help alleviate the financial stress of carrying high credit card balances at astronomically high interest rates by refinancing them into a lower fixed rate mortgage.

GET REAL – Pilot Episode!

Let’s GET REAL! A good Realtor is not the one that GETS your ATTENTION, but rather the one who GIVES you VALUE! This week, I am launching a campaign called “Get Real in Real Estate”…short reels that share real stories that make real impact in real estate transactions. Join me in valuing sincere substance over fake flash.

Are High Mortgage Rates Friend or Foe?

More like a frenemy!

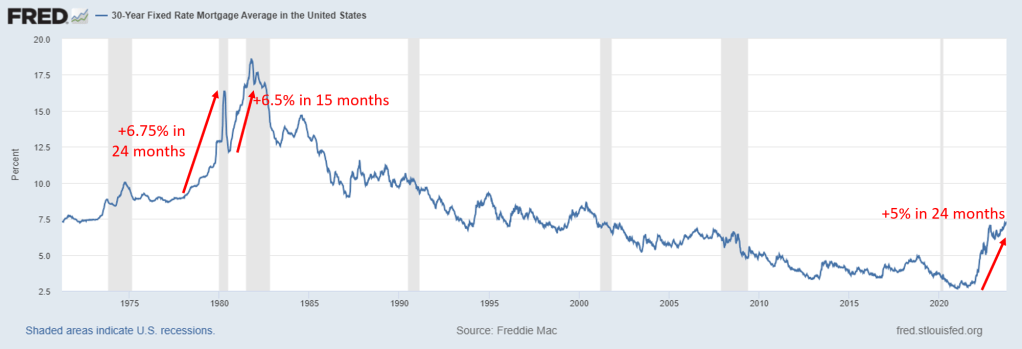

Mortgage rates have officially shot up to their highest levels of the 21st century (that sounds a tad sensational, but its true). Some 30-yr fixed rates are flirting with 8%, over five-percent higher than the all-time lows seen two short years ago. You have to go back to the late 70s & early 80s to see a steeper increase in mortgage rates. Yikes!

These higher rates are making homeownership unaffordable for many. For others, the sticker shock of the monthly payment is too painful to look at, so they continue to rent instead of buy. We covered how this is a poor decision for building long-term wealth at our home-buying seminar last month, but no time to hash that out again in this post.

For the brave buyers who can persevere in this market, they may be facing very favorable conditions in the short months ahead and wonderful appreciation opportunities in the long run. As others turn and run, buyers in today’s market are experiencing much less competition from other buyers, and negotiating with sellers who are beginning to panic as we approach the slower winter months. While no one loves to pay truckloads of interest to the bank, it is worth noting that these higher rates are currently creating a more mellow, favorable market for buyers.

During the 2020-2021 market craze, it was common to have 5-10 competing offers on a listing. In Folsom, for example, the typical listing fetched a price 5% OVER the asking price. Buying a home in that sort of market is frustrating & disappointing, as you have very little control over the outcome of any offer you may write on a home. I believe that type of market craze will return when interest rates drop, but for the moment persistent buyers have the competitive advantage over motivated sellers. Buyers are in the driver’s seat for the next few months!

While its obvious to say higher rates are everyone’s enemy, for some home buyers they should consider them a friend…or at the very least a frenemy!

Here’s a bold game plan to consider if you are a would-be homebuyer…buy now to lock in your home price and then hope to refinance to a better interest rate once rates come down. When rates do eventually settle down, it will likely push home prices up again as more buyers return to the market. Get in front of that wave if you can afford today’s rates & monthly payment!

If you have considered buying a home, then you should read some of my recent posts. There’s one about the benefits of buying a home in the Fall. Another speaks to how mortgage rates will likely drop in the near future. Again, the masses are waiting to buy until rates drop. Consider going against the herd by buying now and refinancing later. Doing so will have far greater long-term benefits, even if the sting of today’s higher rates hurts for the moment.

Fall is for Home Buying!

The best time of year for buyers is now

Today is the Autumnal Equinox! What’s the big deal?

Astronomically, it means the sun is exactly above the equator (any other astronomy lovers in the house??!!).

Practically, it signifies the first day of fall as we begin to experience more nighttime hours than daytime hours.

Economically, it means its the start of the best home buying season in Sacramento!

Don’t believe me? Hear me out…in researching market statistics from the last decade, I’ve debunked the notion that spring & summer are the ideal “buying seasons.” While more people do indeed buy homes during those seasons than any other time of year, the conditions are not as favorable for buyers when compared to fall.

For buyers to have a competitive advantage when buying any product, they need three things:

1.) more buying options relative to the number of competing buyers;

2.) time to consider their options;

3.) stable prices to avoid a market frenzy or buyer’s remorse.

Below are three graphical illustrations that reveal how these factors evolve with the changing seasons, and how fall has consistently been the best season for Sacramento home buyers.

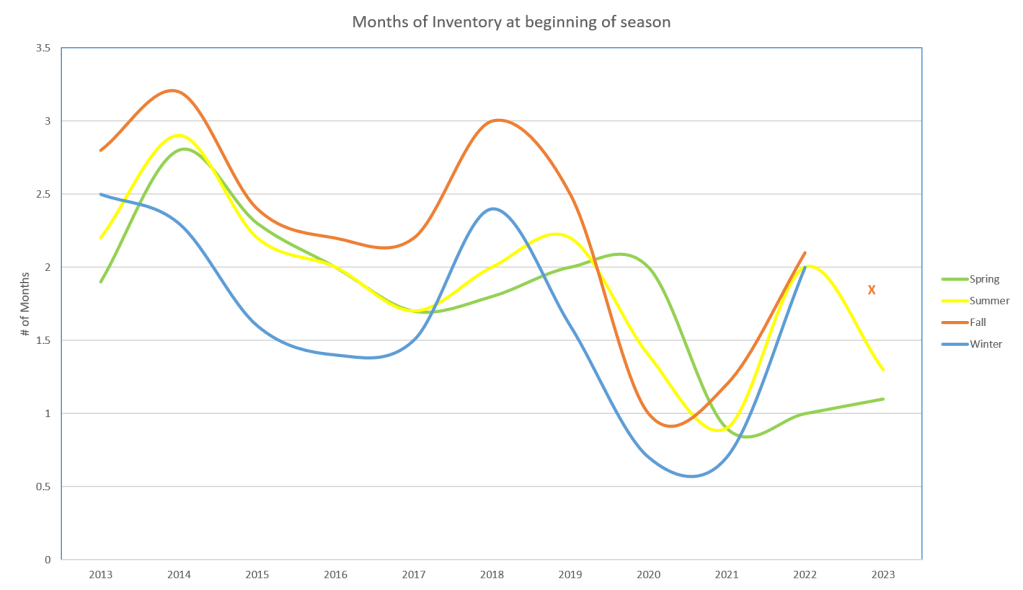

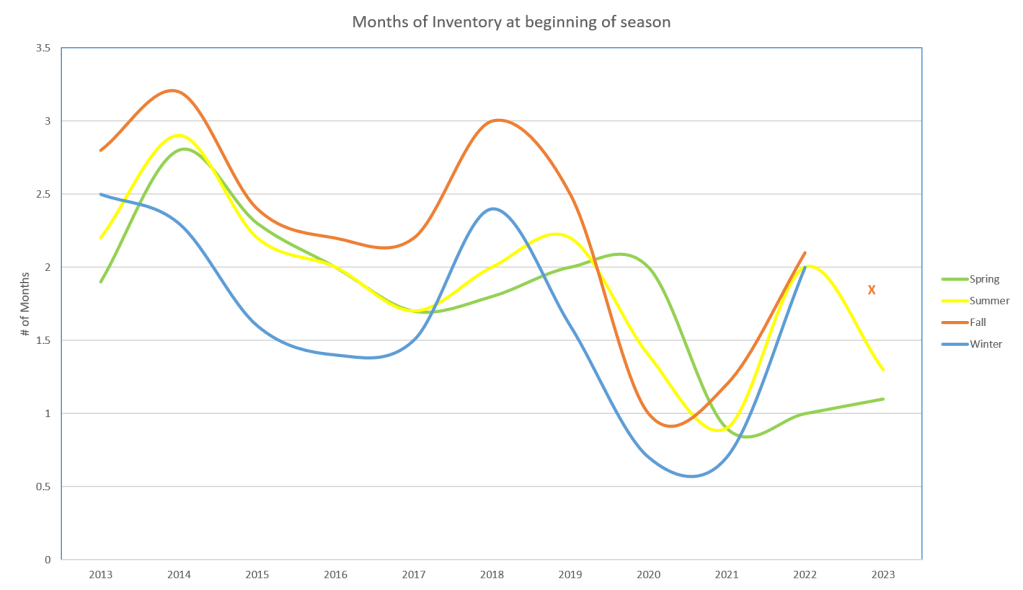

The first compares homes for sale (representing the number of sellers) to the homes that actually sold (representing the number of buyers). From these two figures, our industry calculates a metric known as “months of inventory.” In other words, how many sellers do we have compared to buyers? As a buyer, you want this number to be as high as possible, because it signifies more options for you and less competition against you.

I plotted the last 10 years of Sacramento County home stats, and you can see how in every year (except 2020 when Covid turned everything on its head) the fall season (represented by the dark orange line) has been higher than all of the other seasons. Every. Single Year. And 2023 is shaping up to be the same; as of the time of this post the months of inventory stands at 1.7 months, higher than any other season so far this year.

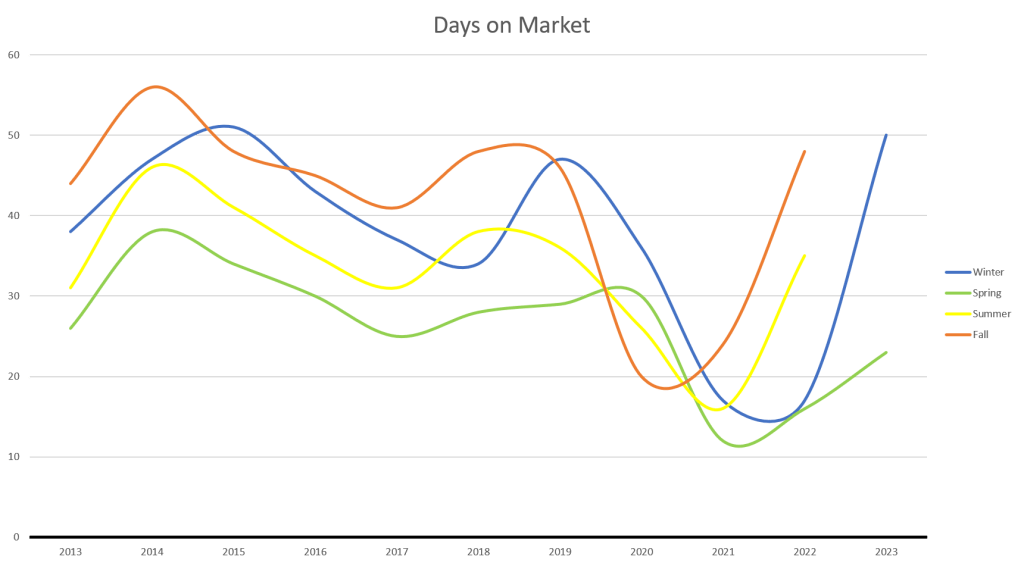

The next factor to favor buyers is time on the market. It is frustrating as a buyer to have homes sell at a feverish pace. Again, fall has shown to be the slowest season in nearly every year, as the average number of days a home sits on the market before selling is the most in fall.

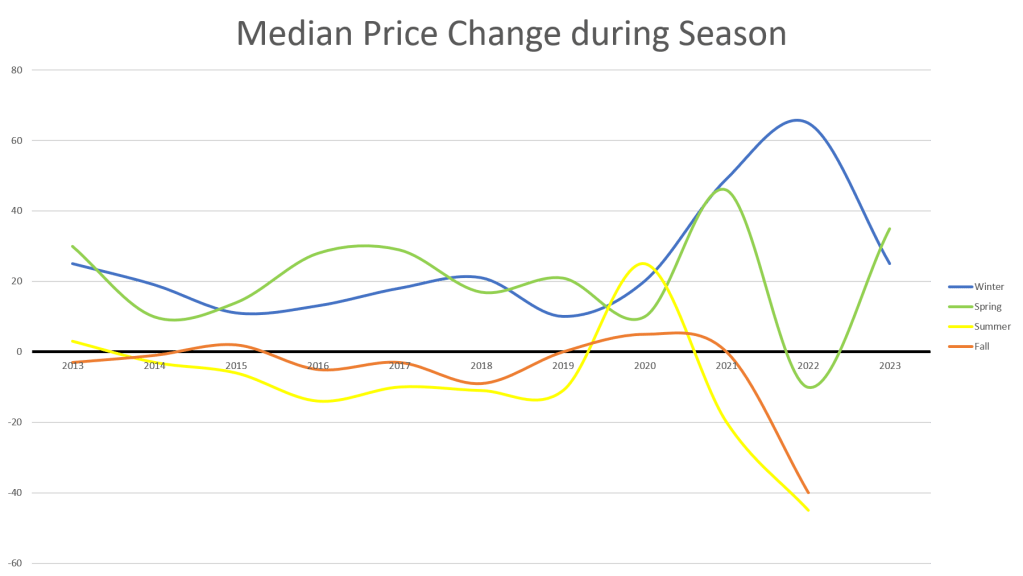

Lastly, prices have remained stable in fall compared to other times of year. In the winter and spring, Sacramento home prices have been significant seasonal price increases nearly every year. Oddly, summer typically sees price decreases of nearly $10,000. Fall, however, has generally experienced stable home prices, illustrated by the dark orange line hovering right around the 0 line in the chart below (except for the odd fall we had last year).

If my graphs above aren’t convincing enough, consider this…REALTOR.com conducted market research and is predicting that the first week in October will be the most favorable week of the year for home buyers to get a great deal on a home!

While its important to understand market trends, buyers and sellers of real estate should avoid the tempting game of attempting to “time the market.” Rather, if you presently find yourself at a point in your life where buying a home makes sense for financial or familial reasons, then don’t wait until spring; act now. Give me a call to help you first secure your financing options, and then let’s get out there and find you a deal on a home this fall!

Attend Our FREE First-Time Home-Buying Seminar

Join us at our Folsom office on September 20th

Our team has been making a ton of preparations to deliver loads of value in our upcoming seminar aimed at helping folks buy their first home.

As a REALTOR people always ask me, “Matt, when is the best time to buy a home?” The answer in real estate is always, “30 years ago!”

But a more helpful answer I can give is “right now!” Yes, as in Fall. Fall is for more than pumpkins, football and flannel. Statistically fall is also the best season for buyers to have the upper hand in the real estate market. Which is why we are hosting a FREE first-time home buying seminar at our Folsom office on Wednesday September 20th.

Below is a visual that shows how fall is the friendliest season for buyers. When comparing homes for sale (representing the number of sellers) to the homes that actually sold (representing the number of buyers), our industry calculates a metric known as “months of inventory.” In other words, how many sellers do we have compared to buyers. As a buyer, you want this number to be as high as possible, because it signifies more options for you and less competition against you. I plotted the last 10 years of Sacramento County home stats, and you can see how in every year (except 2020 when Covid turned everything on its head) the fall season (represented by the dark orange line) has been higher than all of the other seasons. Every. Single Year. And 2023 is shaping up to be the same; as of the time of this post the monthly of inventory stands at 1.7 months, higher than any other season so far this year.

Even if you’re not quite ready to buy right now but hope to buy a home in the future, you should still come and learn about down payment assistance programs, improving your credit score, and generally knowing what to expect when buying a home. You’ll also learn a bit about our firm and why we’re perfectly suited to help you both find and finance your first home.

There’s no cost or commitment to attend the seminar, but space is limited so register here before space fills up. Sign up, grab a pumpkin spice latte on the way and we’ll see you at our office on the eve of autumn & home buying season on Sept 20th!

This will be our final seminar in what has been a very successful Summer Seminar Series. We thank everyone for their attendance, enthusiasm and interest in these important topics we’ve brought to our clients and community this summer.

I Have a Juicy Secret to Share

No one else in the industry is talking about this

We have been hosting valuable seminars all summer long for our clients and community. Initially kicked off on the Summer Solstice back in June, our Summer Seminar Series concludes on September 20th with a seminar aimed at educating and empowering clients to purchase their first-home.

We’ve uncovered several statistical consistencies that show the upcoming Fall season is the best time of year to buy a home in the Sacramento area. This little known secret needs to be shared! We are going to be showing statistically why fall is the ideal home-buying season, explaining the preparation steps first-time home buyers should take, and so much more.

Be sure to share this post with someone in your life who has shown interest in buying a home. This in-person seminar is FREE to attend but space is limited. Click this link to register before space fills up.

Got Debt? You Are Not Alone

If your credit card balances are creeping up on you, it may be time for a cash-out refinance

Total US household debt continues to climb even as borrowing costs rise with higher interest rates, particularly on credit cards. The total debt level recently hit a record amount of $17 trillion…with a T!!!

Over $1 TRILLION is attributed to credit card debt! Many of us are facing harder times with the on-going economic slow down & lingering inflation. With credit card balances & their interest rates at all-time highs, it may be time to consider a cash-out refinance to consolidate high-rate loans.

Home values remain reasonably resilient & most homeowners have record levels of home equity. Even with elevated mortgage rates, it may be better to roll higher rate credit card debt into a new mortgage balance.

Has the economic slowdown forced you to borrow more against credit cards, cars, and education? Borrowing from your equity at a low rate to pay off higher rate debt will lower your overall monthly payments and lower your interest costs over the long-run. I can help you determine the “blended rate” of your various debts, the effective interest rate you’re paying across all of your loans (including your mortgage). If your blended rate is over 6%, then its time to consider a cash-out refinance.

Consider the following graph…according to CreditCards.com the national average credit card interest rate is over 20%!. With The Fed suggesting they don’t plan to reduce the Federal Funds Rate any time soon, this will lead to high credit card rates for some time.

Let us help alleviate the financial stress of carrying high credit card balances at astronomically high interest rates by refinancing them into a lower fixed rate mortgage.

Mid-Year Market Check-In

Just when I thought the market couldn’t get any wonkier…

The real estate market is never boring. I’ll give it that. After a Jekyll & Hyde year in 2022 when things began red hot and ended ice cold, I was expecting a rather “ho-hum” year for the 2023 Sacramento real estate market. So far, its been anything but routine. Let’s dive into the details and stats to find out where we may be going.

Back in January (see the post), I had made the following predictions:

1. The “bear” market would end;

2. Interest rates would settle down; &

3. Home prices would bottom out.

Well, if you’ve been paying even casual attention to the market and economy, you know that I got 2 out of 3 right. While the market has indeed come out of hibernation with increasing home sales and an end to steep price declines, it has done so in spite of interest rates remaining stubbornly high. This has come as quite a surprise to nearly everyone. After all, higher rates were the reason for the late 2022 market slowdown, so why would anyone expect the market to rebound if rates remained at elevated levels???

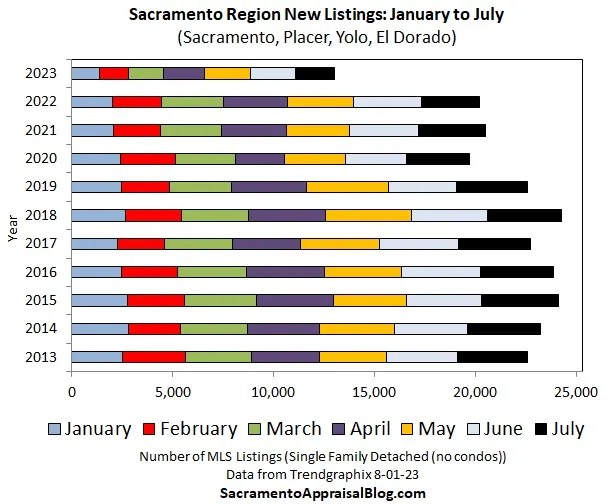

The surprise X-Factor in 2023 has been the astonishingly low number of homes for sale. Let me try to put this in perspective…in every year from 2013 to 2019 (pre-pandemic market), the greater Sacramento region saw 23,000 to 24,000 homes for sale from January thru July. So far this year, that figure stands at nearly half that amount at 13,000!!! Below is a great statistical visual from my favorite appraiser, Ryan Lundquist, that clearly shows how odd this year has been. Every month has seen significantly fewer new listings come to market compared to historical norms.

So even with mortgage rates remaining around 7% and pricing many buyers out of the market, home prices have actually been able to increase since there are so few options for the remaining buyers to purchase.

Think of it this way: let’s say you want to buy the new iPhone 15 that comes out next month. Then right before the release, its discovered that all of the 85 million new iPhones produced have a fatal manufacturing defect and can’t be sold.

As a result, you will think twice about buying or upgrading your phone since this market disruption would drastically increase the prices of the limited remaining phones in the market. You will likely just hold onto your old phone even if it had problems as the cost to upgrade is just too great.

That’s precisely what’s happened in the real estate market! But instead of a manufacturing defect/recall keeping homes out of the market, high mortgage rates are to blame, acting like “golden handcuffs” on homeowners. Golden handcuffs are often referred to when employees feel locked into their jobs because the conditional future benefits are too good to walk away from today. Similarly, homeowners feel locked into their homes as more than half have mortgage rates under 4%. The cost of “upgrading” is simply too great, so they stick with their current home even if its not really what they want.

They’re pretty, but they’re still handcuffs

Similarly, your low mortgage rate is saving you money, but its got you locked in. How does it feel to be chained to your current home?

All of this means is it’s the PERFECT time to sell if you don’t have to buy again in the same market or if you owe little or nothing on your home mortgage. Home values are arguably over-inflated due to the low supply, and there are still buyers able, willing, and needing to purchase. If you have considered selling your home, we should chat about how to best take advantage of the current market conditions.

Interest rates were to blame for 2022’s abrupt halt & 2023’s oddities, so its very important we keep an eye on the rate horizon if we want to predict where the market is heading as we approach 2024. I wrote a fun Top Gun themed post earlier this summer about how I think mortgage rates will improve later this year, and another post adding to that argument is in the works (coming later this month). Lower mortgage rates will break the chains for many would-be handcuffed sellers, improve affordability for buyers, and ultimately lead to a revival for this incredibly sedated real estate market.

If you may be in the market to buy or sell in the next 12 months, call me now to discuss your circumstances and how I can help you navigate this ever-evolving market. There are indeed opportunities out there if you know where to look and have professional guidance.

Workshop for ADUs (Accessory Dwelling Units)

Have you ever thought about building a tiny home? Come to my workshop!

It’s now more attractive & easier than ever to build an Accessory Dwelling Unit (ADU) on your property. Our community does not have enough housing units to accommodate our growing population, which is why we’ve experienced record increases in home values and rental rates in recent years. State laws have been eased to allow ADUs to be built in nearly every residential neighborhood in Sacramento!

As part of our Summer Seminar Series, we are hosting an IN-PERSON ADU workshop on August 16th @ 5:30 PM at our office at 1847 Iron Point Road in Folsom. Come & learn how city & county planning departments are implementing these changes to ADU permits, and how local builders are creating customized & comfortable units that are attractive and appealing to residents. In the workshop you’ll receive a one-on-one consultation on your options to add an ADU to your property this year!

Refreshments will be served. Industry experts will be on site to answer questions about planning, building, and financing your ADU. We look forward to seeing you there. Register today below for your free spot before we fill up!