Zillow operates as an advertising platform rather than a public information service. Higher search rankings for houses or agents do not imply quality; they reflect the amount spent on advertising. Users should be wary, as top results may simply be influenced by financial investment, much like Google’s advertising model.

Category: Real Estate

GET REAL – Loan Assumptions

Let’s Get Real about Loan Assumptions. With current mortgage rates holding steady at their highest levels in decades, some believe a way to afford their next home purchase is to assume a seller’s existing loan at a much lower interest rate. Sounds like a great life hack, right??!! Why take out a new mortgage at 7% or more when you can assume an old one at 3% or less? While it is true that some loans are assumable, the odds of one being available on a home that you actually like and end up buying are next to zero.

I helped a recent client locate a home in Fair Oaks that was perfect for them. The seller was a veteran; my buyer was a veteran. VA loans are one of the few types of loans out there that are assumable; seemed like a match made in heaven!

But here’s the unfortunate reality…the loan assumption application process is cumbersome and takes time; often 1-2 months. This particular seller wanted a clean, fast sale, so even though the listing promoted the assumable nature of the mortgage, the seller ultimately selected a buyer who could purchase the home without assuming the existing VA loan.

Very few listings will have an assumable loan. And those that do will likely be very popular, and the seller may not be inclined to go through the assumable application process. Sure, I can help you filter home searches based on assumable loans (there’s 14 for sale in all of Sacramento County at the moment & 21 sales in all of 2024), but I wouldn’t recommend hanging all of your homeownership hopes on an assumable loan.

It’s Over! Now What?

How will the real estate market change post-election?

It’s been 2 weeks since the presidential election, and things are coming into focus. Cabinet appointments, Republican Congressional control, and local election results have led to an abundance of prognosticators & instigators proclaiming with near-certainty how everything from our global alliances to our drinking water will change.

Some see the end of days approaching, while others foresee brighter days ahead.

Time will tell if any of these professed changes actually come to be.

But will our local real estate market change? Is there any truth to the predictable nature of home buyers and sellers pre and post presidential elections? As always, let’s look at the data to find out!

In recent days, statisticians at both the national and local levels have shared their insights on how elections have historically influenced the real estate market. Both revealed some interesting trends on the surface.

First up, the national numbers. Zillow writer Jordan Teicher shared insightful data last week from the last 25 years that shows the number of transactions tend to decrease from October to November (just before the election) in election years (-3.7% on average) while in non-election years there is a +.6% increase. Furthermore, the change from November to December (just after the election) saw a bigger increase in election years (+2.4%) compared to non-election years (+.9%).

As a result, one could conclude that market activity tends to slow down before and pick up after presidential elections. But keep in mind that these are national statistics, and it’s always a good idea to look at more local numbers when assessing real estate markets. For that, we turn to local appraiser Ryan Lundquist.

Ryan astutely shared on his latest blog post that while Sacramento home prices and mortgage rates have no correlation to election cycles, the number of transactions does appear to be influenced. In most months we see above-average sales in the year after an election.

But, he quickly points out that the trend is only due to outlier sale figures from the market boom year of 2005 & market bust year of 2009. If you exclude those two years from consideration, you lose any statistical trend showing a post-election “pop” in the market.

It’s common to stare at historical data long enough in order to find a favorable story about the future.

It is wise to refrain from doing so.

Many people, including yours truly, are hoping for an increase in market activity in the coming months. Any changes, however, will have nothing to do with the election. Instead, it will depend on buyer affordability.

Elevated mortgage rates and record-high home prices have made home-buying more expensive than ever. Any increase in market activity will require mortgage rates to fall or rent rates to increase where buyers feel better about taking the financial plunge into homeownership.

Double Honors

#1 Real Estate Team and #3 Mortgage Broker!

We’re overjoyed to announce that Style Magazine recently recognized us as the #1 Real Estate Team and #3 Mortgage Broker in the Folsom/El Dorado Hills area! This dual distinction is a testament to our team’s dedication to delivering exceptional service and expertise in both real estate and financing.

A quick Zillow search shows over 4,000 real estate agents serving the Folsom area. Moreover, hardly any of these agents also offer financing, so earning awards in both categories is truly humbling. We’re grateful for the trust our clients have placed in us, and we’re thrilled that our unique, one-stop-shop approach resonates with our community.

We extend our heartfelt thanks to Style Magazine for this recognition and to our valued clients for their votes. Your support means the world to us!

Discover how our comprehensive real estate and mortgage services can elevate your next transaction. Explore my blog & website to learn more about our team and our award-winning approach to real estate.

Are Home Prices At All-Time Highs?

The answer depends on where you look

Recent headlines have touted “All-Time” Highs for home prices. Despite higher mortgage rates, the real estate market has marched upward, with most areas seeing price increases over the past year.

In fact, the median home price in California topped $900,000 for the first time ever in April and climbed even further in May! But while these state-wide numbers are indeed at all-time highs, many markets across the United States, including most here in Northern California, are still trying to claw back the 15-25% losses realized in 2022.

Here are some charts that show while home prices are increasing, they are still lower than the 2022 peaks.

Sacramento County – Median Home Price

Sacramento County home prices peaked in May 2022, with the median home price topping out at $575,000. Things dropped considerably in the following 6 months, giving back 16%. Since early 2023, home prices have risen steadily, but still are under the 2022 peak.

Folsom – Median Home Price

Folsom experienced a similar pattern, but the fall was more pronounced. After peaking at $850,000, Folsom home prices dropped 20% in the second half of 2022. The current median home price is $775,000, much higher than the low in late 2022 but still not at all-time highs.

El Dorado Hills – Median Home Price

El Dorado Hills had one of the biggest pullbacks in 2022. EDH home prices peaked a bit earlier in 2022, and spent the entire year sliding down from nearly 1.12M to $800,000 (28%). Things have mostly recovered as the median home price sits at nearly 1.08M, but not an all-time high.

United States – Median Home Price

This trend is common not just in Northern California, but all around the country. Nationwide, home prices hit their all-time highs in 2022 and have attempted to climb back to those levels ever since.

Don’t see your city on this post? I have stats on most areas of California. Send me a message and I can put together a custom presentation of your market.

It’s May Madness. Bring on…EVERYTHING!

May seems to always be the most hectic month of the year. Graduations, picnics, school parties, sports, boating…commitments and fun keep us busy all month long, and I’m sure the same is true for you.

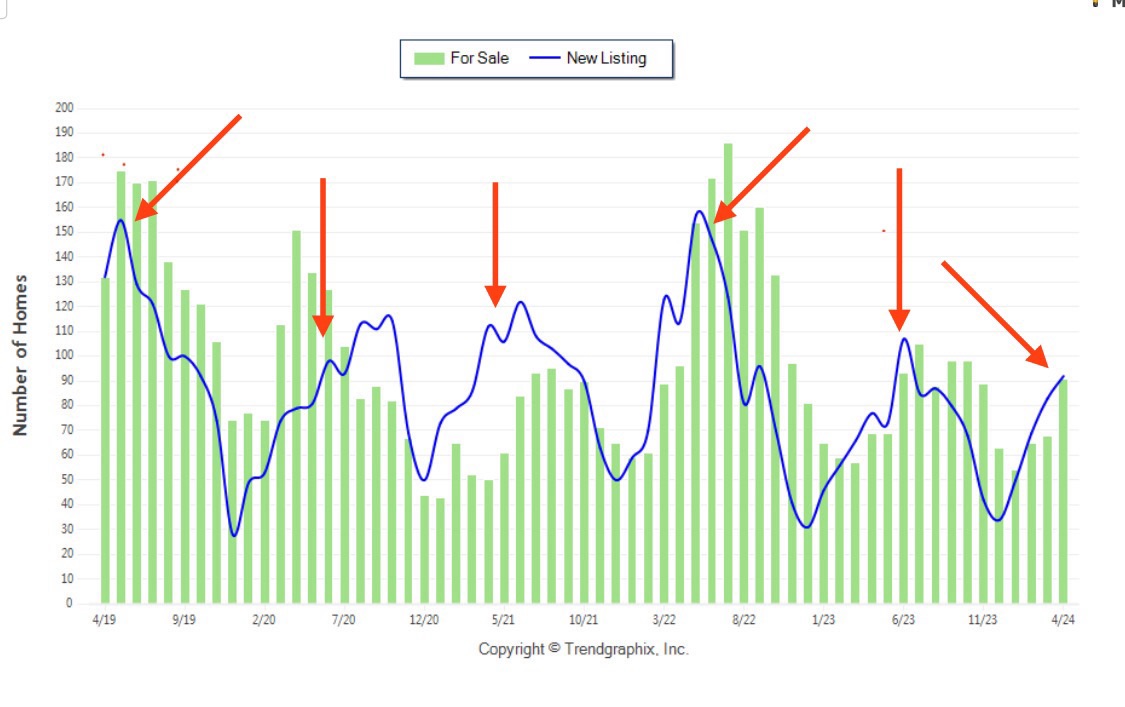

The real estate market has a way of hitting its full stride in May as well. For the last few years, May has signaled the time when many homeowners decide to put their homes on the market. This year appears to be similar as I’ve already listed two homes for sale in recent days. This is a good sign for the market at large since the single greatest issue we have in our market is too few homes for sale. Yes, that’s a bigger issue than high mortgage rates (although one could argue these issues are linked together)!

At the time of this writing, there are fewer than 100 single-family homes for sale in Folsom.

This is an incredibly low amount, considering we are a town of over 80,000 people and 28,000 housing units. Over the last few years, beginning in May, we start to see this figure increase through the summer months, but since interest rates began rising two years ago we have seen the number of homes for sale in the summertime decrease dramatically.

What will this summer bring? Unfortunately, much of the same. Unless I get more calls from clients interested in selling their homes this summer, I expect the number of homes for sale to be similar to last summer. For current homeowners not looking to move, this is great news. For those looking to buy their first home, this is truly discouraging, at least for now.

I am anticipating mortgage rates to improve in the second half of the year, which will likely do two things: #1) more buyers will re-enter the market due to improved affordability; and #2) more “move-up” and relocating sellers will choose to put their home on the market as they feel less committed to remaining in their current home to hold on to an ultra-low mortgage rate. This increase in both demand and supply should keep prices level while increasing options for buyers.

Much like May’s relentless calendar, the real estate market keeps chugging right along despite challenging conditions. Either way…Bring. It. On.

LATEST LISTING – 4346 Prodperine Lane

This listing won’t last long! It’s literally the only home in the entire Sacramento region priced under $600,000 that provides over 2000 sq ft of single-story living space in a gated community built in the last 20 years.

Visit www.AspenVillageHomeForSale.com for full details.

GET REAL – Buyer Always Pays

Let’s Get Real about Buyers Paying Real Estate Commissions. Much of the recent news coverage of the real estate industry has focused on the shift that buyers now may be the one paying their REALTOR commission. Well, this shouldn’t be a newsflash, but the truth is the buyer ALWAYS pays.

Let me break this down for you. Say a homeowner sells their home for $500,000. Before the seller sees a dime of that $500,000, the transaction costs, including real estate commissions, are paid out through closing using the funds the buyer brought to the closing table. So who’s money actually paid those commissions? Oh yeah, the buyer’s money! It doesn’t matter if that money was from the buyer’s down payment or from the buyer’s loan…it was the buyer’s side of the transaction that made paying those commissions possible.

The actual thing that’s changing is a seller can no longer advertise a pre-determined commission amount to the buyer’s agent as a part of the MLS marketing. But rest assured a buyer’s REALTOR commission will still be negotiable and paid at closing. Maybe from time to time its paid by the buyer directly or, more likely, worked into the price of the home as it more commonly is now.

But make no mistake about it, either way the buyers always pay.

GET REAL – Price Fixing

Let’s Get Real about Price Fixing in Real Estate. There is this misguided myth that our industry price fixes commissions, and nothing could be farther from the truth. In my 22 years in this business, I have never, ever had anyone tell me how I should structure a real estate commission.

You’ll find a ton of click-bait headlines out there today proclaiming that a recent REALTOR class-action lawsuit settlement aims to drastically cut commissions in the real estate industry, but if the market really demanded lower commissions it doesn’t need a class-action lawsuit to enable that. The American real estate agent marketplace is one of the most competitive and creative industries in the world, and no one is out here telling practitioners or consumers that commissions are fixed.

In fact, on every California listing contract it’s put in bold lettering to advise sellers that commissions are not fixed. And if a market disrupter wanted to come in and offer lower commissions to consumers, which they do constantly, they are certainly at liberty to do so.

No one is going to convince me that 2 million realtors are acting as a unified cartel who is fixing commissions, and you shouldn’t let anyone convince you too. Home buyers and sellers have been able to and will continue to be able to negotiate commissions with their selected REALTORs at will.

GET REAL – Commissions

Let’s Get Real about Commissions. There have been a ton of sensational headlines in recent days about a settlement the National Association of REALTORs proposed last week, and I’m here to set the record straight.

There are some who think this settlement will revolutionize how real estate transactions work. Well, that may be true in Missouri where the class-action lawsuit was initially filed, but out here in California we already operate very similarly to the proposed settlement terms.

For example, the biggest change will decouple commissions, meaning the seller pays their realtor and the buyer pays their realtor. Now, there are some significant downsides to mandating decoupled commissions that we don’t have time to get into on this post, but again in California there are already buyer contracts that state a buyer is ultimately responsible for paying their own realtor. While not required, I’ve been using these buyer-agreements for years and require all of my team to use it too so I don’t anticipate significant changes to my practice and interactions with clients.

In most transactions today the seller ends up compensating the buyer’s agent, and I think that will remain the norm. Informed and intelligent sellers will continue to see the value a buyer’s agent brings to the successful marketing and sale of their home, and will continue to offer compensation at similar levels as they do today.

The procedural changes proposed in the settlement agreement are not finalized and even if they do they won’t take effect until the second half of this year, so it’s a bit too soon to know exactly how things may play out, but rest assured REALTORs will continue to be a valuable part of clients home buying and selling experiences.