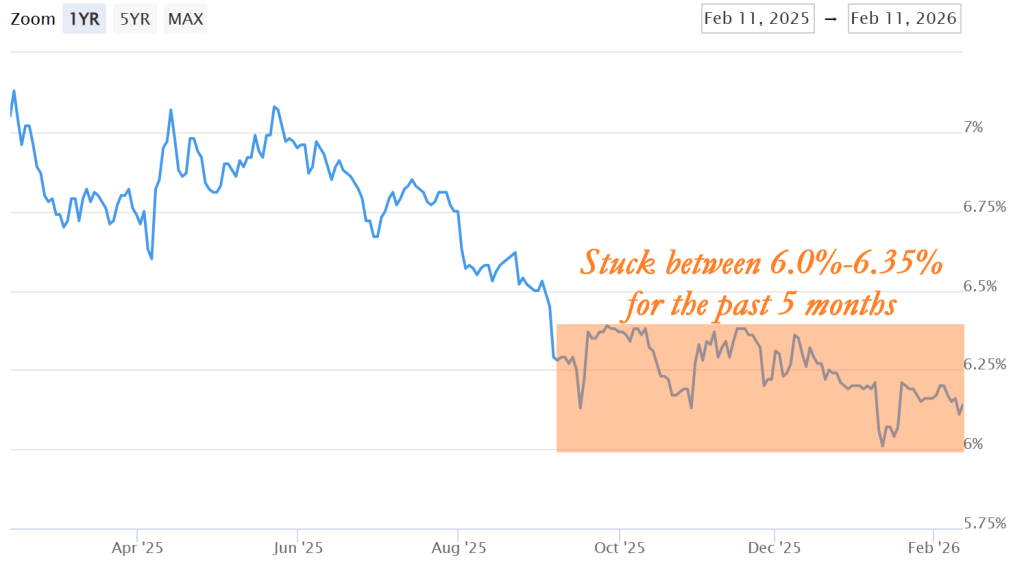

After several years of sharp increases and unpredictable swings, mortgage rates have finally entered a period of relative stability. While rates remain higher than the historic lows of 2020–2021, the consistency we’re seeing in recent months is creating something the market has been missing: confidence.

So what does this mean if you’re thinking about buying or selling?

Stability Brings Predictability

When mortgage rates move dramatically, buyers tend to pause. Rapid changes create uncertainty about monthly payments, purchasing power, and timing.

Stable rates, even if they’re not “low,” allow buyers to:

- Calculate payments with confidence

- Plan financially without fear of sudden spikes

- Move forward without constantly trying to “time the market”

In other words, stability reduces hesitation.

It Could Always Be Worse

Given the incredible volatility in financial markets over the past year, we should be thanking our lucky stars that rates are as low as they are. Stubborn inflation, low unemployment rates, stock market rallies, tariff wars, record government debt levels, international conflicts, and domestic unrest have consumed headlines over the past year. These are all factors that tend to push rates higher. And yet, mortgage rates have fallen 1% during that time. Phew!

Buyers Are Adjusting

The initial shock of rising rates initially experienced in 2022 has worn off. Today’s buyers are adjusting expectations and focusing on:

- Long-term value

- Negotiation opportunities

- Seller concessions

Sellers Benefit from Serious Buyers

Stable rates also filter the market. The buyers actively shopping right now are motivated and realistic. They’ve done the math. They understand today’s financing environment.

For sellers, that means:

- Fewer “just looking” showings

- More qualified buyers

- Stronger negotiations

- Less last-minute fallout due to rate swings

Well-priced homes are still moving.

Return to a More Normal Market

For the past 5 months, rates have stayed within a .3% range; the lowest level of volatility seen since 2021. When rates are flat like this, buyers & sellers both begin to accept these rates as the new normal and make more confident decisions.

Bottom Line

Stable mortgage rates may not grab headlines the way dramatic hikes or cuts do, but they bring something even more important: confidence and clarity.

And confidence is what moves markets.