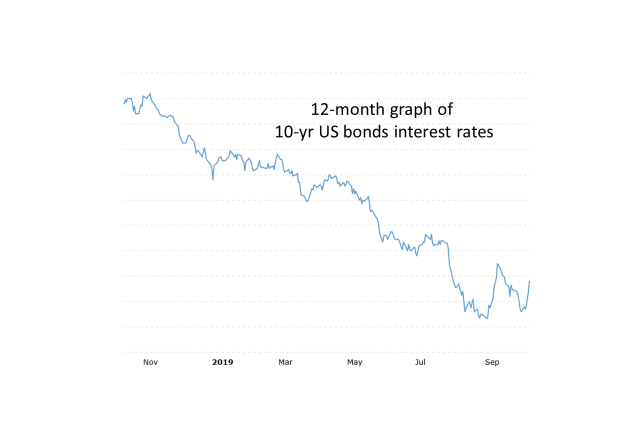

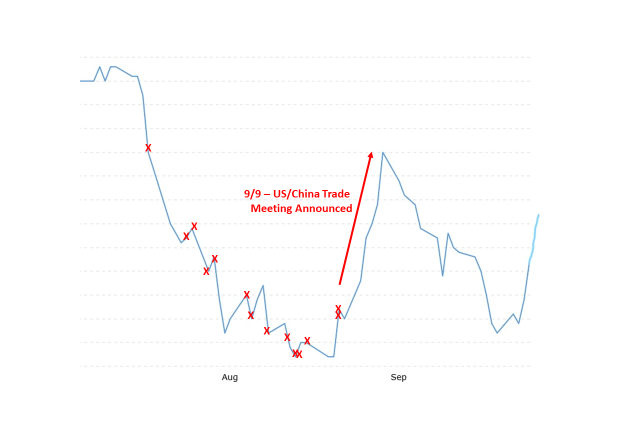

The stage is set this week to be an incredibly volatile one filled with newsworthy headlines. These stories could have huge implications for mortgage rates. Generally speaking, mortgage rates fall when economic indicators are sluggish or uncertain. This week’s scheduled events could make markets very nervous and, depending on the outcomes, push rates lower.

Here is a list of stories in the making this week:

December 10th – The World Trade Organization (WTO) will cease to operate. This multi-lateral trading system underpins 96% of global trade, but our American government has put a block on appointing new judges. Two judges are retiring this week, so there will not be enough judges to hear new cases. While this event has been in the making for months (if not years), its significance is noted, especially given the rising trade war tensions around the world. With no “sheriff in town,” the “gun-slinging cowboys” of global trade may feel brazen to impose stiffer trade rules and costs.

December 11th – The last Fed press conference of 2019. After two back-to-back rate reductions in the Federal Funds rate, most analysts are expecting The Fed to not take any action in this week’s meeting. However, what they say in their press conference could have ripple effects through the world’s financial markets

December 12th – British election that will shape the fate of Brexit. A special election is being held on the hope that the Prime Minister’s party will win majority in their parliament. If that takes place, the Conservative Party’s agenda, which includes a quick exit from the European Union, will forge ahead more swiftly.

December 15th – New round of tariffs set to take effect on $160,000,000,000 of Chinese goods (that’s a lot zeros!!!). With no sign of a written trade agreement between the two biggest economies on the globe, it is possible the next round of scheduled tariffs on Chinese imported goods will take effect. While prior tariffs have targeted production materials, this tariff will directly apply to finished Chinese goods sold in America, including cell phones and other electronic and household products. With less than a week to go, it is still uncertain if this latest tariff is a threat or a promise. Its anybody’s guess how the next few days will play out in the financial markets, and its by far the most important story to follow in the coming days.

![USA and China trade war[1]_ US of America and chinese flags crashed contain](https://mattsmemos.com/wp-content/uploads/2019/08/usa-and-china-trade-war1_-us-of-america-and-chinese-flags-crashed-contain-e1565976584261.jpg?w=660)

Indeed, uncertainty is high, and I think there is potential for mortgage rates to fall in the days ahead. Peek back at my August and October blog posts that share my thoughts on these story lines in the past, and give me a call if you want my forecast on whats ahead.

Most California homeowners received their property tax bill in recent days.

Most California homeowners received their property tax bill in recent days. Every year the county assessor’s office determines the assessed values of properties from which to calculate your property tax bill. California has many state laws, most notably Proposition 13, that skew one’s assessed value. Thus, the assessed value is often lower than true market value. Occasionally, the assessor’s office gets it wrong and assesses your home for MORE than the market value,

Every year the county assessor’s office determines the assessed values of properties from which to calculate your property tax bill. California has many state laws, most notably Proposition 13, that skew one’s assessed value. Thus, the assessed value is often lower than true market value. Occasionally, the assessor’s office gets it wrong and assesses your home for MORE than the market value,  All counties have an appeals process to reconsider your assessed value

All counties have an appeals process to reconsider your assessed value