That was The Fed’s message to markets this week

On Wednesday, The Federal Reserve Board left their Federal Funds Rate unchanged. This was widely expected amongst financial markets, yet stock markets rallied and mortgage rates fell at once. What gives?

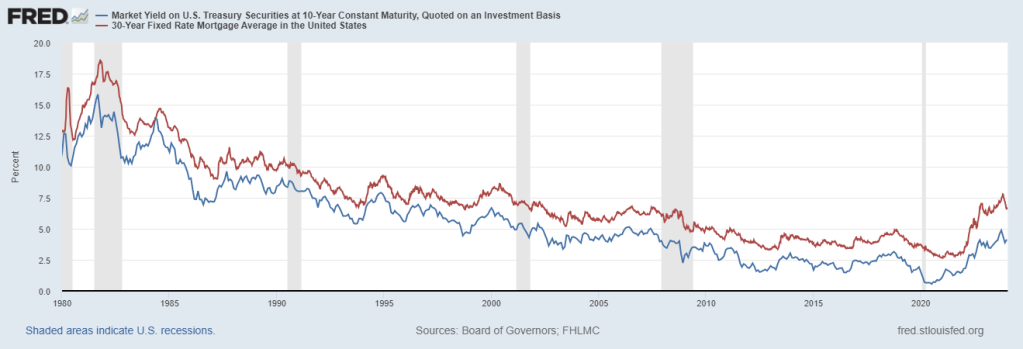

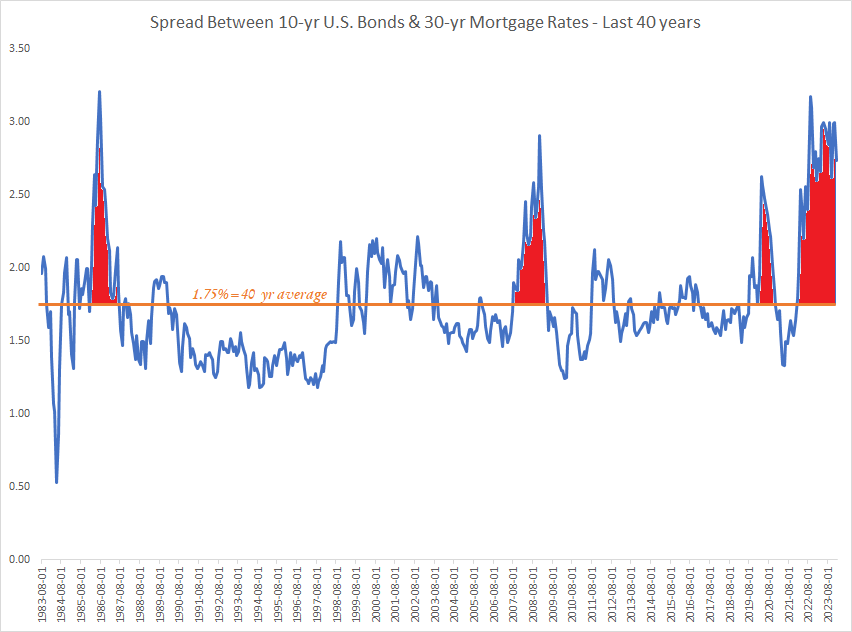

Simply put, markets change when the expectations of future events change. They don’t wait for the actual event to take place. To illustrate, here is a chart showing how The Federal Funds Rate (in red), has not changed in 12 months and yet mortgage rates (in blue) have been bouncing all over the place as market expectations have evolved over a myriad of variables (inflation, elections, economy, etc.).

This week was no exception; markets followed the words and largely dismissed the actions of The Fed. While the Federal Funds Rate was left alone, The Fed strongly suggested they see economic conditions that merit lowering the rate in future meetings later this year. Markets cheered these words, as mortgage rates had one of the best weeks in some time!

It can be hypocritical for parents to insist that their children “do as I say, not as I do.” In this case with the markets being the “kids” and The Fed being the “parents,” the market is dutifully following the words of The Fed by pushing mortgage rates down despite The Fed holding their rate steady. In fact, mortgage rates dropped to their lowest levels since April 2023, and will fall further if The Fed keeps true to their word in their next meeting. But, if The Fed reverses course like a hypocritical parent, then the markets (& mortgage rates specifically) will throw a fit and rise rapidly.

All in all, it has been a great week for mortgage rates. Let’s hope this rally continues!