But are the shades for protection???

Timbuk 3, a 1-hit wonder from the 80s, wrote “Future’s So Bright, I Gotta Wear Shades” and is often interpreted to mean there are exciting events ahead. For example, I couldn’t help but hum the song this past weekend as we helped move our daughter into her freshman dorm at college. She has her whole life in front of her; full of potential and promise. Her future indeed looks bright and we are so proud of her!

But, the band actually ironically intended the song lyrics to be a grim outlook of nuclear fallout fears during the height of the Cold War. The shades referenced were not a cool fashion statement, but rather to protect your eyes from a bright nuclear blast!

I study nuclear science

I love my classes,

I got a crazy teacher

He wears dark glasses.

*image from Universal’s Oppenheimer film

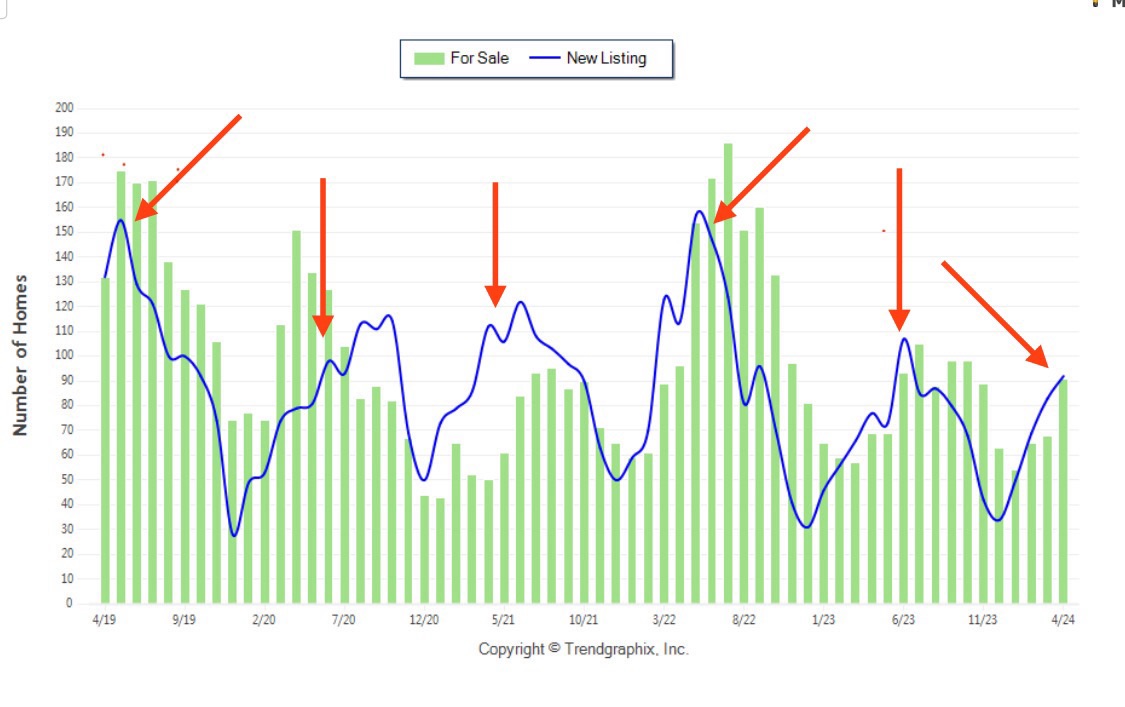

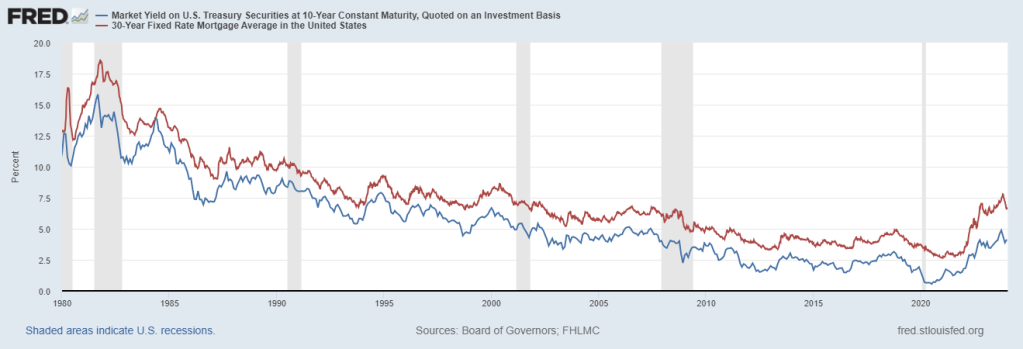

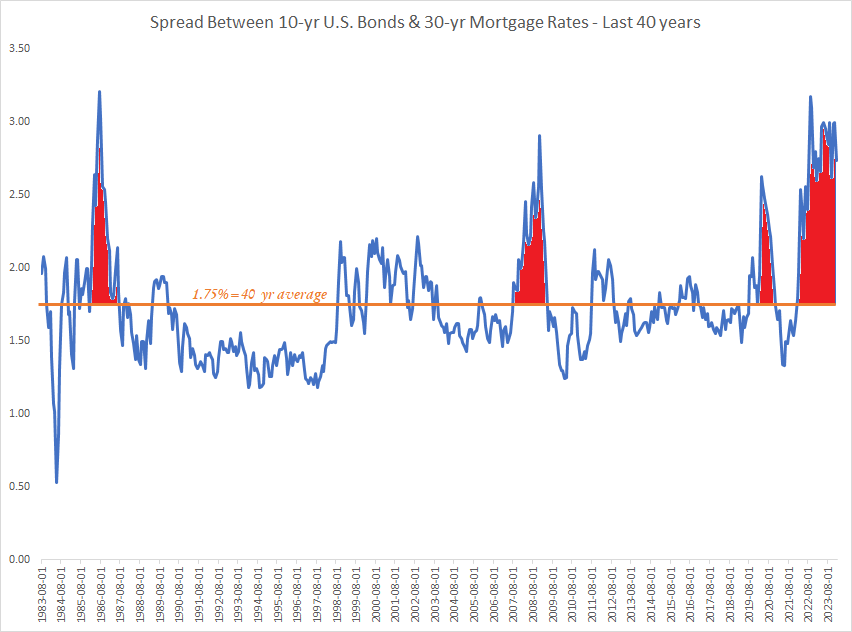

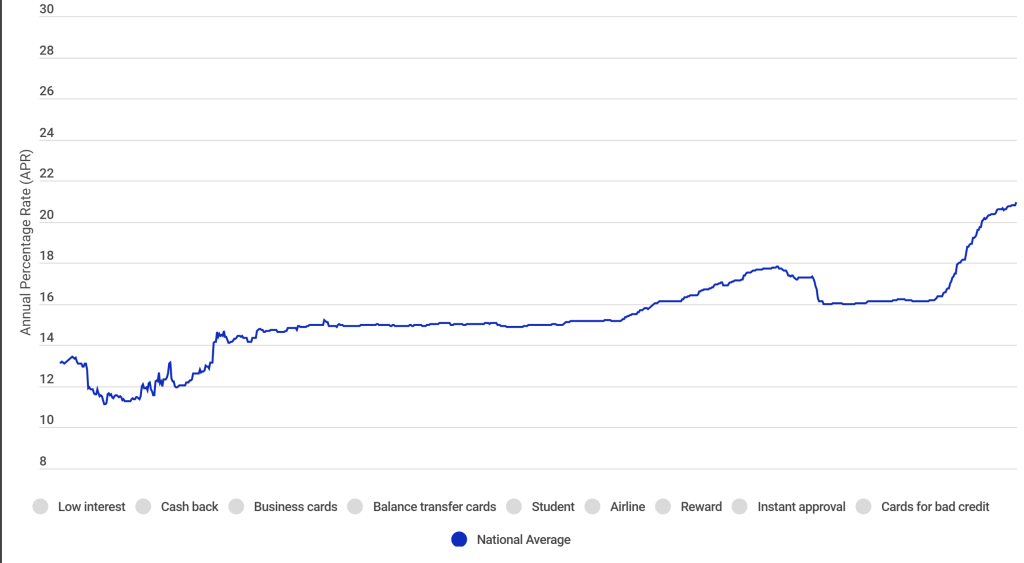

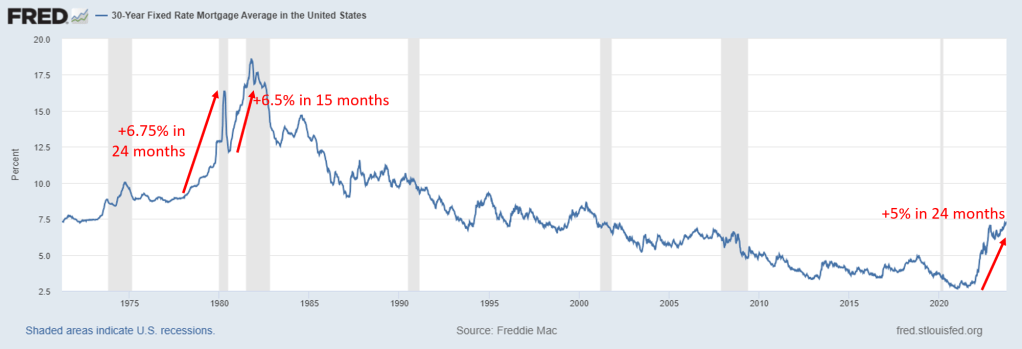

Where am I going with this??!! Well, the current economy is at a crossroads and up for varying interpretations as well. After three years of rampant inflation, interest rates have begun falling. We are currently helping several folks refinance who purchased homes in 2023 at higher rates, and we expect to do much more of that in the coming months. You can say the future looks bright for those looking to refinance and save on their mortgage payment!

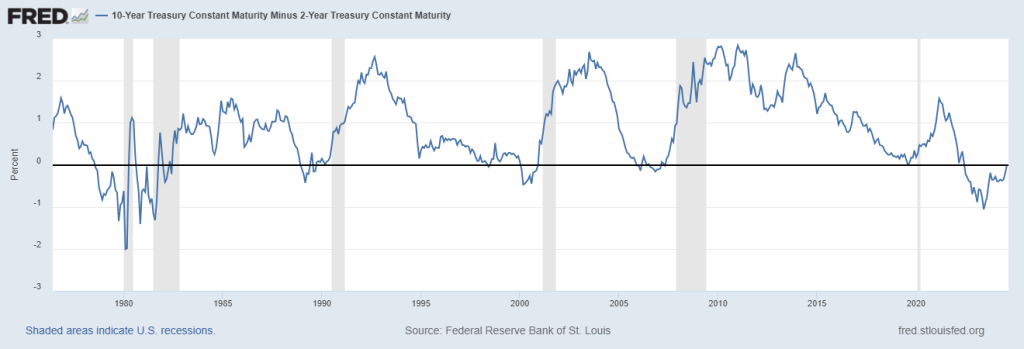

On the other hand, interest rates are settling down largely due to growing signs of a slowing economy. Unemployment rates are rising, global stock markets are very volatile, and statistical patterns suggest a recession is right around the corner (see below). While the future looks bright for mortgage rates, a larger economic doom could also be on the horizon.

If you have been waiting for a lower mortgage rate to either refinance or purchase a home, the future does indeed look bright for you. You should call us now to set a “target rate” that makes sense for you to pursue a refinance or home purchase. Let us help you look at the market through the right “shades” and keep an eye on factors that may push rates lower so you can best prepare for a refinance opportunity.