It’s that time of year where one day feels like summer and the next winter. Last week I put away my outdoor furniture, only to want to haul it out just a few days later to enjoy the warm sunshine! And today the forecast was for over an inch of rain and it’s looking like we won’t even get half that. It’s tough to plan with such wild weather swings!

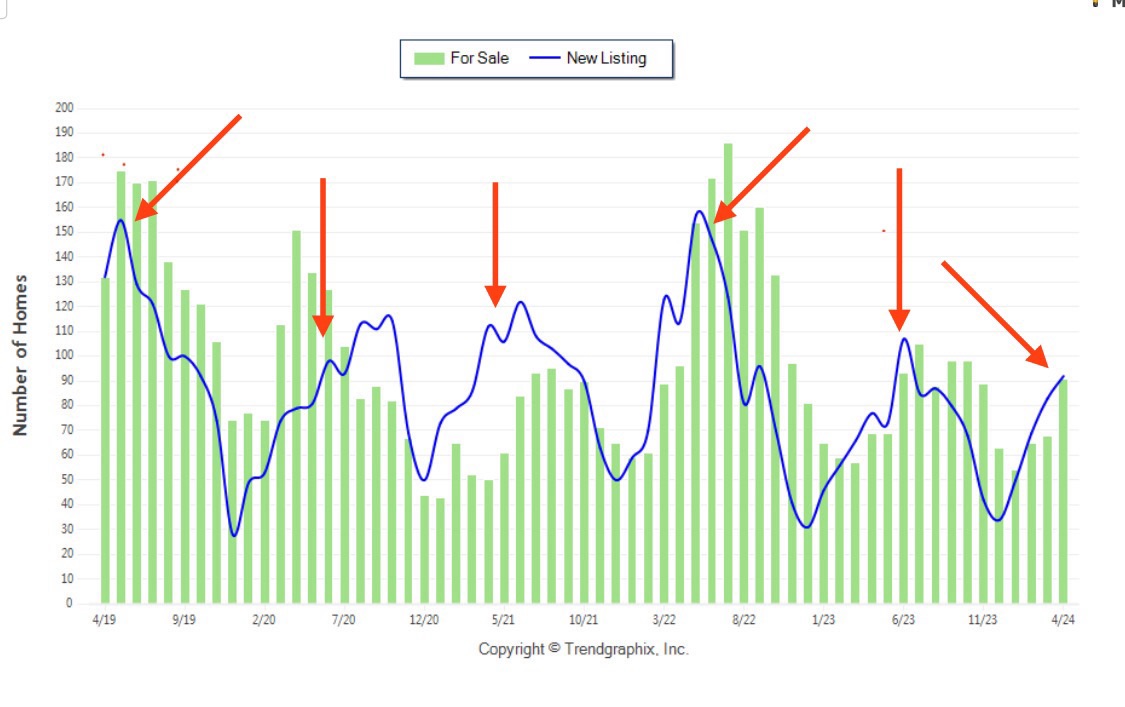

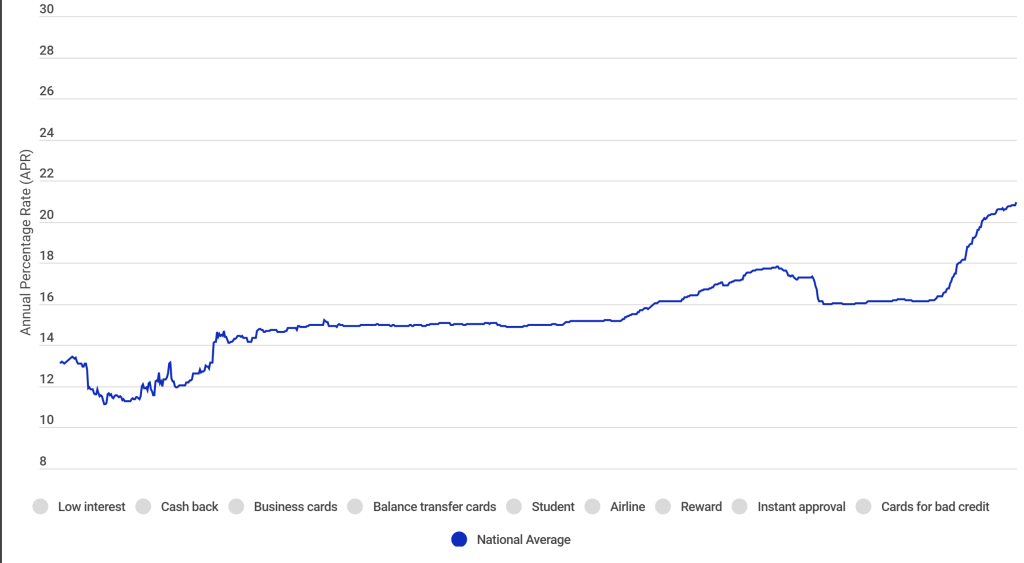

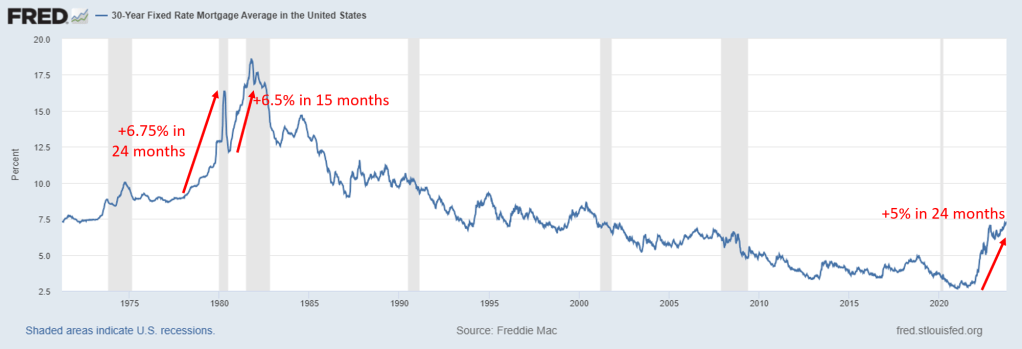

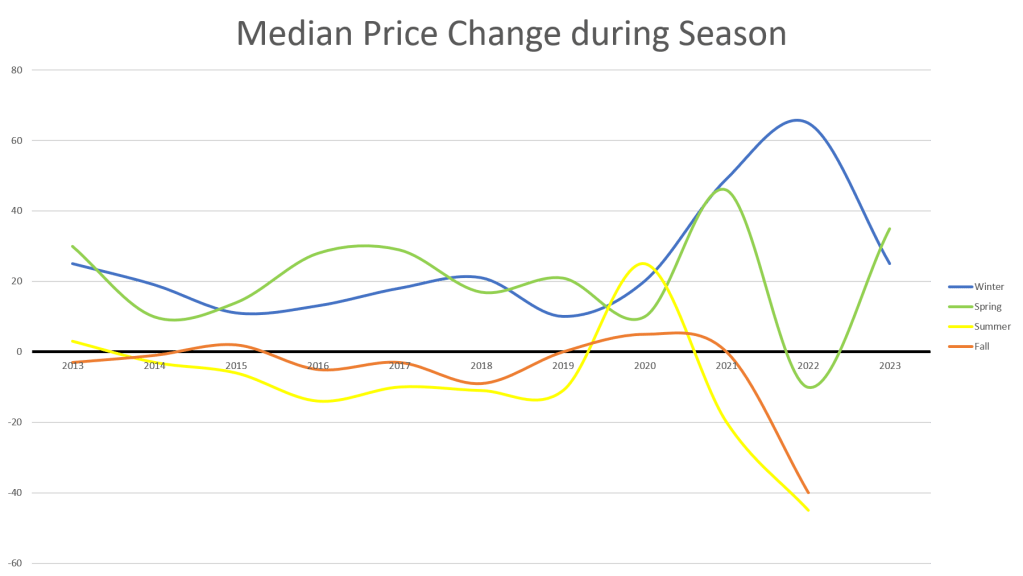

The real estate market is similar at the moment. After an encouraging September where home sales surprisingly increased year-over-year in most parts of the state, October showed disappointing figures. With such inconsistent trends, identifying the vibe of the market is harder than ever. The government shutdown, high cost of living, and unpredictable mortgage rates are all impacting the real estate market in unpredictable ways.

You can read the signs

and still get it wrong!

I have a number of clients hoping to sell their homes in the coming months, and many of them are trying to time the market. They ask me questions like,

“Should I list for sale now before the holidays?”

“Should I wait till Spring?”

“How much more will my home be worth in 2026?”

Just ask me if it’s going to rain on Christmas while you’re at it! In all honesty, timing the market is a lot like timing the weather. You can read the signs, but ultimately its impossible to pull off every time. Here’s a throwback video I shot discussing this analogy.

Even though I’m an expert and live & breath market statistics and trends, I can’t predict the real estate future with any certainty. That’s not what you should expect of me or any real estate professional. What you should expect is help identifying what is most important in your next real estate transaction and navigating through it without losing sight of your priorities. Sellers often get caught up in timing the market that they forget why they are selling in the first place.

I have a client who lives in a home that no longer suits her and the property is bleeding her money in repairs. There are 2 homes that sit on 10 acres and require a lot of upkeep, so this widower recognizes she needs to live in a simpler, low-maintenance home. That is the priority; to change her lifestyle that will improve her health and finances.

But sadly, the quest of maximizing her sales price based on market timing has taken over. And during this quest, she has changed her mind several times, questioned herself, and ultimately is shackled in indecision. All the while, the property expenses are piling up and she loses sleep worrying about what to do. She keeps asking herself “when,” while the most important question she needs to ask herself is “WHY.” Why am I selling my home?

Does this sound familiar to anyone you know? Perhaps your own situation? When toiling over an upcoming home sale, ask me these questions instead:

“What is my home worth right now?”

“Where should I put my focus on improving my home for a sale?”

“Who can help me make this process as easy as possible?”

In short, control your controllables, and most importantly…FIND YOUR WHY. Why are you selling your home? Allow me to help you never lose sight of that.