I’m sure you’ve heard the news…mortgage rates have finally been falling! But if you’re sitting on a high mortgage rate should you hold off on a refinance until after the upcoming Fed press conference?

Many people expect The Federal Reserve to lower the federal funds rate 1/4-1/2% on September 17th. But what most people misunderstand is this has no bearing on when or even if mortgage rates drop. Mortgage rates have already fallen nearly ½% in the past 30 days due to the same market conditions that are prompting The Fed to cut their rate next week. Mortgage rates don’t wait for Fed policy; mortgage rates change in real time as market conditions change.

Here’s my advice…if your mortgage rate is currently at 7% or above and you have good credit and home equity, look into refinancing now. Don’t get greedy and hope rates get even better next week. It’s worth pointing out that the last time The Fed lowered their rate, mortgage rates actually increased. As the old adage goes, better to take the bird in the hand, instead of two in the bush.

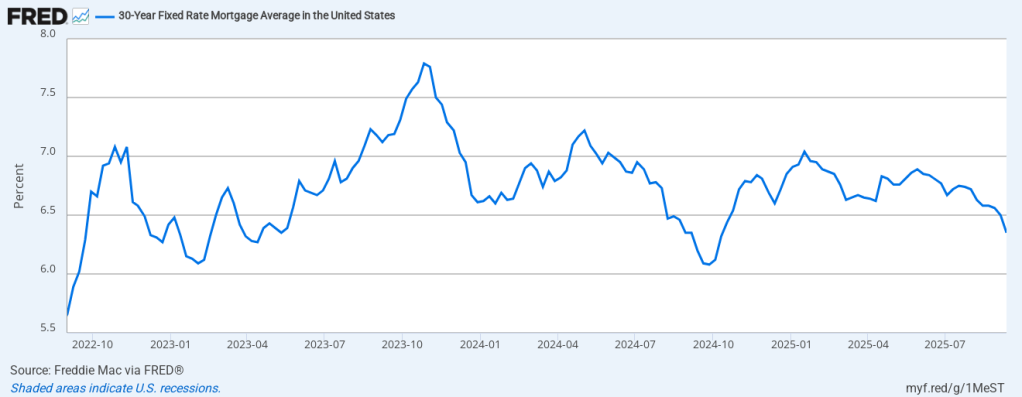

As the chart below illustrates, mortgage rates have not dipped below 6% in the past 3 years. And each time they approach that barrier, they bounce HARD in the other direction, rising 1.0-1.5% in the following months. We are testing that 6.0% barrier again. Will it break through this time? Or get rejected for the third time in three years?

But, if your mortgage rate is already in the 6s and you’re not interested in shortening your term to a 15 yr loan, then “roll the dice.” Sit tight and see if rates fall further. I wouldn’t count on it happening right away, but there’s always that small chance lower rates are on their way.

I’ll be working this weekend and can even lock your refinance rate during after-market hours. Hit me up if you want to explore your refinance options with an experienced & local mortgage broker before the high volatility of next week’s Fed meeting impacts the financial markets.