More like a frenemy!

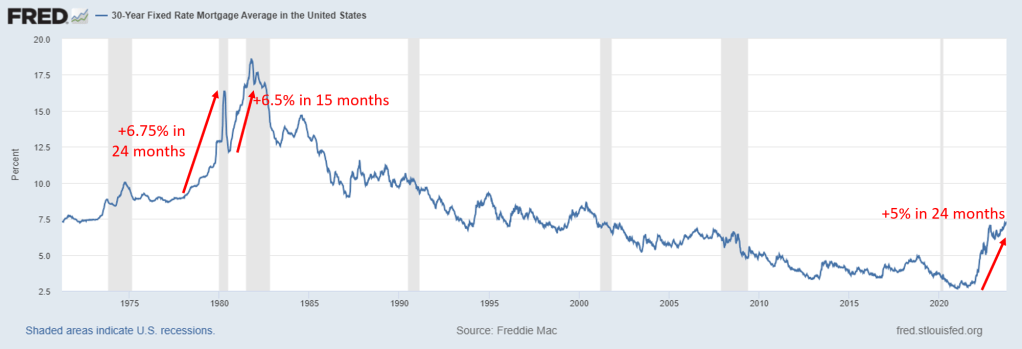

Mortgage rates have officially shot up to their highest levels of the 21st century (that sounds a tad sensational, but its true). Some 30-yr fixed rates are flirting with 8%, over five-percent higher than the all-time lows seen two short years ago. You have to go back to the late 70s & early 80s to see a steeper increase in mortgage rates. Yikes!

These higher rates are making homeownership unaffordable for many. For others, the sticker shock of the monthly payment is too painful to look at, so they continue to rent instead of buy. We covered how this is a poor decision for building long-term wealth at our home-buying seminar last month, but no time to hash that out again in this post.

For the brave buyers who can persevere in this market, they may be facing very favorable conditions in the short months ahead and wonderful appreciation opportunities in the long run. As others turn and run, buyers in today’s market are experiencing much less competition from other buyers, and negotiating with sellers who are beginning to panic as we approach the slower winter months. While no one loves to pay truckloads of interest to the bank, it is worth noting that these higher rates are currently creating a more mellow, favorable market for buyers.

During the 2020-2021 market craze, it was common to have 5-10 competing offers on a listing. In Folsom, for example, the typical listing fetched a price 5% OVER the asking price. Buying a home in that sort of market is frustrating & disappointing, as you have very little control over the outcome of any offer you may write on a home. I believe that type of market craze will return when interest rates drop, but for the moment persistent buyers have the competitive advantage over motivated sellers. Buyers are in the driver’s seat for the next few months!

While its obvious to say higher rates are everyone’s enemy, for some home buyers they should consider them a friend…or at the very least a frenemy!

Here’s a bold game plan to consider if you are a would-be homebuyer…buy now to lock in your home price and then hope to refinance to a better interest rate once rates come down. When rates do eventually settle down, it will likely push home prices up again as more buyers return to the market. Get in front of that wave if you can afford today’s rates & monthly payment!

If you have considered buying a home, then you should read some of my recent posts. There’s one about the benefits of buying a home in the Fall. Another speaks to how mortgage rates will likely drop in the near future. Again, the masses are waiting to buy until rates drop. Consider going against the herd by buying now and refinancing later. Doing so will have far greater long-term benefits, even if the sting of today’s higher rates hurts for the moment.